If you’re getting Supplemental Security Income (SSI) and are wondering about food stamps (also known as SNAP, or Supplemental Nutrition Assistance Program), you’re not alone! It’s a common question. Figuring out how different government benefits interact can be tricky. This essay will break down how food stamps and SSI work together, answering your questions about whether getting food stamps will impact your SSI payments. We’ll cover the rules, what to expect, and other important things to know.

Will Food Stamps Reduce My SSI Payments?

Let’s get straight to the point. No, getting food stamps will not directly reduce your SSI payments. They are separate programs, and the amount of food stamps you receive doesn’t directly affect the money you get from SSI.

How SSI Works Briefly

SSI provides money to people with disabilities or who are elderly and have very limited income and resources. The amount of SSI you receive depends on your income and resources. The Social Security Administration (SSA) looks at things like any wages you earn, other benefits you get, and what you own, like bank accounts or property (excluding your home). They have limits on how much you can have to qualify. It’s designed to help cover basic needs like food, shelter, and clothing.

Here’s what SSI focuses on when considering income:

- Earned Income: Money from a job.

- Unearned Income: Things like Social Security benefits, pensions, or gifts.

- Resources: Things you own like bank accounts.

Remember, SSI has specific rules and income limits. These rules can change, so it’s always a good idea to check with the SSA for the most up-to-date information.

How Food Stamps (SNAP) Works Briefly

Food stamps (SNAP) helps low-income individuals and families buy food. Unlike SSI, SNAP is managed by the state, although the federal government sets the rules. The amount of food stamps you get depends on several factors, including your household size, income, and some expenses (like housing costs). The goal is to help make sure you have enough money to buy groceries each month.

Here’s some of the requirements:

- You must meet certain income requirements.

- You must meet certain resource requirements.

- You must reside in the state you apply in.

- You must meet certain work requirements, if applicable.

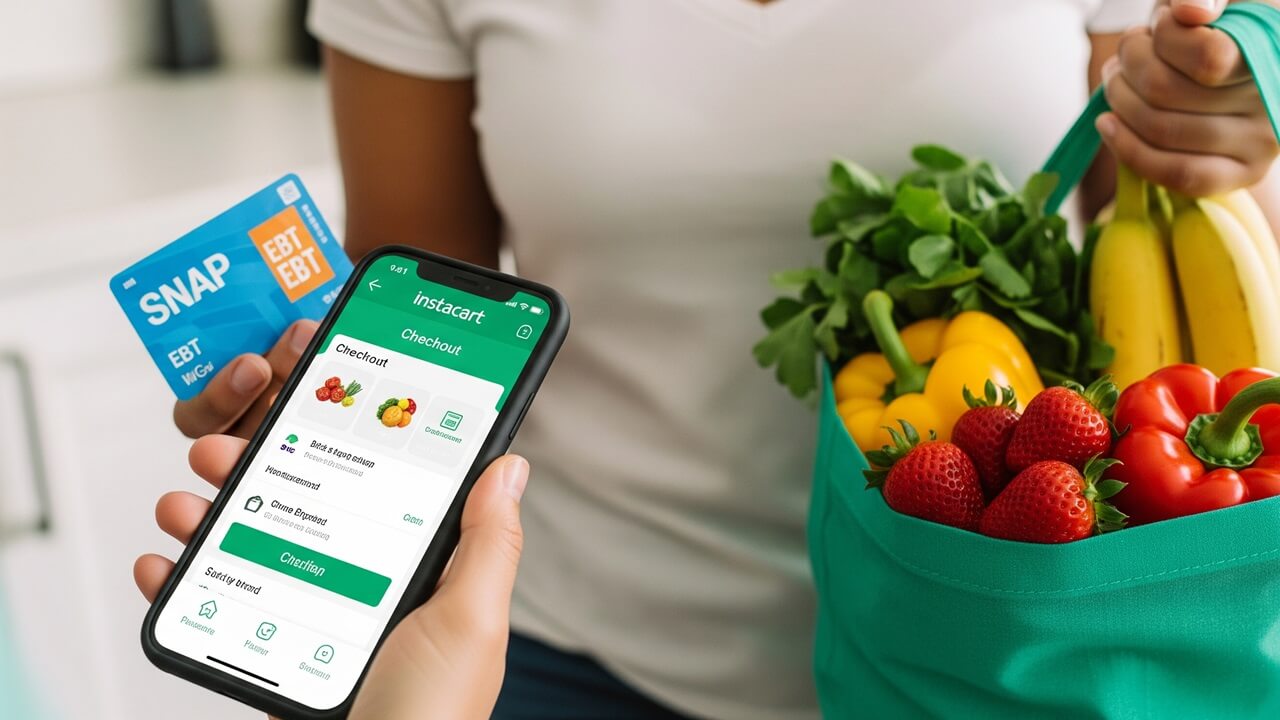

Food stamps come in the form of an Electronic Benefit Transfer (EBT) card, which works like a debit card at grocery stores and some farmers’ markets.

The “In-Kind Support and Maintenance” (ISM) Rule

While food stamps themselves don’t affect SSI, there is something called “In-Kind Support and Maintenance” (ISM) that could potentially affect your SSI. ISM is when someone else pays for your food or shelter, or provides it to you for free or less than fair market value. This could include a friend, family member, or even a charity. If you receive ISM, the SSA considers this unearned income. If the SSA decides you are receiving ISM, it can reduce your SSI payments.

The way the SSA determines ISM is a bit complicated. Here’s a simplified example:

- Let’s say you live with a friend, and they pay the rent and utilities.

- The SSA would assess the value of the shelter provided.

- They would then use a formula to determine if and how much your SSI would be reduced.

ISM rules don’t apply to food stamps. However, it is crucial to understand how it works.

How Receiving Food Stamps Impacts ISM

So, how does receiving food stamps relate to ISM? The good news is that food stamps themselves don’t count as ISM. Since you are getting the benefit directly, the SSA doesn’t count this as something that’s being provided to you for free. This means that getting food stamps doesn’t automatically trigger an SSI reduction due to ISM. This is important because if a family member or friend is helping you buy food, that COULD be considered ISM.

However, it’s important to keep the rules straight. In the example above of living with a friend who pays rent, receiving food stamps wouldn’t change how the SSA assesses ISM for shelter.

Here is an example of how ISM could be calculated:

| Element | Description |

|---|---|

| Value of Shelter | $800 per month |

| ISM Reduction | Up to 1/3 of the federal benefit rate (FBR), plus $20 |

The amount could fluctuate slightly over time.

What If I Share a Home and/or Food?

Things get a little more complex if you share a home and/or food with someone else. If you are part of the same household, the SSA generally considers your income and resources when determining your SSI eligibility and payment amount. Sharing food, however, doesn’t necessarily mean that you’ll be penalized. It’s the *value* of support you’re receiving from someone else that matters for ISM.

Here’s an example: Let’s say you live with a family member who buys all the groceries, and you don’t contribute any money. The SSA could potentially assess the value of the food you are receiving as ISM. However, if you both use food stamps, this is less of a concern, because the food is directly provided to you.

Here are some points to keep in mind:

- Document Everything: Keep records of who pays for what, if you are sharing expenses.

- Report Changes: Always tell the SSA about changes in your living situation or income.

- Seek Advice: If you’re unsure, contact your local Social Security office.

Remember, each situation is unique, and the SSA will assess it based on the specific facts.

Reporting Requirements: Keeping the SSA Informed

It’s super important to tell the Social Security Administration (SSA) about any changes that could affect your SSI benefits. This includes things like changes in your income, living situation, or resources. While getting food stamps itself doesn’t need to be reported, you must report any change in your income or other benefits. If you don’t report changes, it could lead to overpayments, and you might have to pay the money back later. The rules are strict, and honesty is the best policy.

To report, you can usually do it in a few ways:

- Call the SSA: You can call their toll-free number.

- Visit your local Social Security office: You can go in person.

- Use the SSA’s website: You can do some things online.

It’s a good habit to keep your contact information up-to-date with the SSA, so they can reach you if they need to.

What If I Don’t Qualify for Food Stamps?

Sometimes, people might not qualify for food stamps. This could be due to their income or resources being too high, or other reasons. If you don’t qualify for food stamps, that doesn’t affect your SSI in any way. You’ll continue to receive your SSI payments as long as you meet the eligibility requirements. Food stamps are just one form of assistance.

If you don’t qualify for food stamps, there are other programs or resources that might be able to help with food or other needs.

Here’s a short list:

- Food banks

- Soup kitchens

- Charities

- Other government assistance programs

Your local Social Security office can sometimes offer information about other assistance programs in your area, as well as your local food bank.

Conclusion

In a nutshell, getting food stamps *won’t* directly lower your SSI payments. The two programs are separate. However, remember to report any changes that might affect your SSI. Understanding how the programs work and keeping the SSA informed will help you navigate the system and make sure you receive the benefits you’re entitled to. If you’re ever unsure, it’s always best to contact the Social Security Administration directly for clarification. They are there to help!